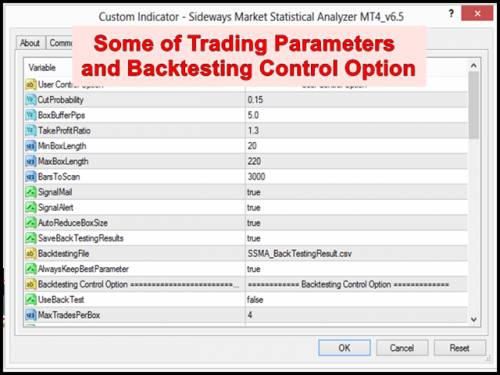

Important Trading Parameters

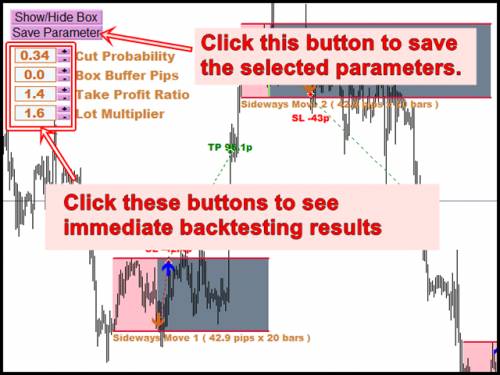

- Cut Probability – you can enter from 0.01 to 0.99. The value will mostly stay between 0.05 and 0.5. This cut probability is the criteria to qualify the Sideways Movement of current group of candle bars based on the probability distribution.

- Box Buffer Pips – you can enter from 0 to 100. The value will most stay between 0 and 10. The pip value is the offset distance from the detected Sideways Market. This will be represented by long horizontal line above and below the detected Sideways Market on your chart. This line can be used as the trigger point for your buy and sell orders.

- Take Profit Ratio– Take Profit Ratio is the Ratio of your take profit pips/box height. The value will most stay between 1 and 3. 1 indicates that your take profits pips are equal to the height of box.

- Lot Multiplier – Lot multiplier is used when your previous trading hit stop loss. The value will mostly stay between 1.5 and 2.0. It is recommended to use value less than 1.7.

Other Important Options

- Bars to Scan – This is the number of candle bars to detect Sideways Market. Depending on your speed of PC, set it accordingly. Recommended value is between 3000 and 4500 (9 month for H1 time frame).

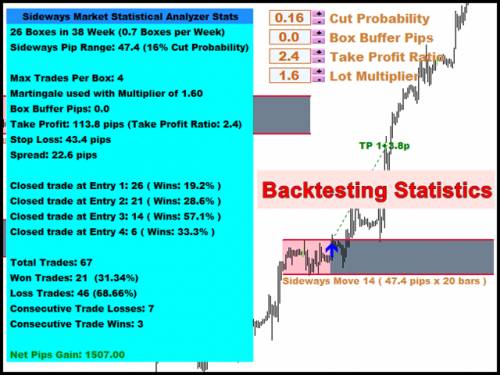

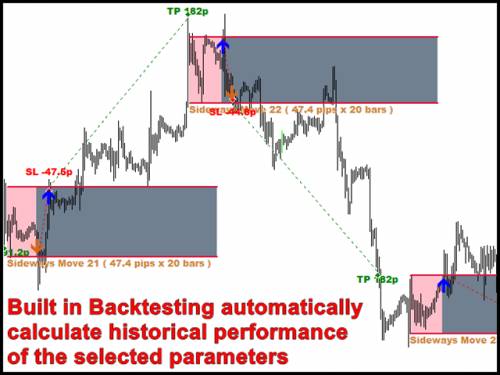

- UseBacktest – If UseBacktset is set as true, then your Sideways Market detection will be only started again after the virtual trading simulation is completed for the previous detected Sideways Market. For example, if MaxTradesPerBox is set as 4, then new Sideways Box will be detected only after the 4 virtual transactions are done. If UseBacktest is false, then the virtual trading simulation will not be performed. Therefore, as soon as there is the next Sideways Box, the Analyzer will detect them and it will show them on your chart.

- MaxTradesPerBox – Default is set as 4. 4 means that four virtual orders will be used for each detected Sideways Box during the virtual trading simulation (backtesting). Value 4 is recommended usually.

Get Risk Management Tool to assist your trading And it's free

One single most important factor in the financial trading world is to control your risk. We found two interesting observations when we train Junior Forex Traders. Firstly until the trader understand the Risk Management, the trader's expected return isn't consistent. For example, some trader earns 100% in a month but they lose 100% in next month. This is not the path we recommend for you. Secondly after the risk management is taught, the traders really start to enjoy the trading. It is because they know that their risk is controlled and they have a piece of mind even with holding overnight position. We want you to be profitable but we also want you to enjoy trading with our software too. Therefore, we provide Risk Management Tool to you for free of charge. It is originally designed to work with our software including Harmonic Pattern Plus, Price Breakout Pattern Scanner and Sideways Market Analyzer. However this Risk Management Tool will work on its own without other Software. So please enjoy your trading with this free tool. How to use this tool is very simple. The tool will calculate the lot size according to your specified Risk per Balance when you enter Stop Loss and Take Profit in points value.

- Recommended Risk per Balance is 1% (0.01) to 3% (0.03) depending on your trading skills and experience for each trade.

- Recommended to enter trade if Take Profit is greater than Stop Loss unless you are scalper.

- Aim 3 to 5 trades per day at least.

We provide the Risk Management Tool for both Meta Trader 4 and Meta Trader 5. Just click the link below to download this software.

Your Definite Guide for Price Action and Pattern Trading Package

Our Forex Trading software are designed for different level of traders from beginners to Professional Traders. Here you can find out the complete list of Price Action and Pattern Trading Software.

Starter Trading Package 1

Price Action Candle Detector + Risk Management Tool (free) + NRTR (free, http://www.mql5.com/en/code/8349)

Intermediate Trading Package 1

Harmonic Pattern Plus + Risk Management Tool (free) + other technical indicator Template provided from us (free).

Intermediate Trading Package 2

Price Breakout Pattern Scanner + Risk Management Tool (free) + other technical indicator Template provided from us (free).

Professional Trading Package 1

Harmonic Pattern Plus + Price Breakout Pattern Scanner + Risk Management Tool (free) + other technical indicator Template provided from us (free).

Professional Trading Package 2

Harmonic Pattern Plus + Price Breakout Pattern Scanner + Sideways Market Analyzer + Risk Management Tool (free) + other technical indicator Template provided from us (free).

Few Tips on choosing the Right Package for You

In our experience, the prediction power between Harmonic Pattern and Price Breakout Pattern is similar. Here is our advice for weighting our Price Action and Pattern Trading software:

Harmonic Pattern = Price Breakout Pattern > Price Action Candle Detector

Sideways Market Analyzer works more like EA. So it is difficult to compare it with other software. The main difference between these software is that harmonic Patterns and Price breakout patterns are formed over many candles bars (i.e. sometimes over 100 candle bars.) whereas Price Action candle Detector detects patterns with 2 or 3 candle bars. Therefore, Harmonic Pattern and Price Breakout Pattern naturally provide you stronger market view over Price Action Candle Detector. Having said this, Price Action Candle Detector is still very accurate. In terms of learning curve (how easy to learn the software), our rating is like this:

Price Action Candle Detector > Harmonic Pattern > Price Breakout Pattern > Sideways Market Analyzer

Just like “The little book of Sideways Market by V. N. Katsenelson” introduces readers the importance of understanding Sideways Market, Sideways Market Trading Strategy can accelerate your success if you are aiming to become the top 5% traders. In our experience, Mastering Sideways market should be followed after your complete training for bullish and bearish market trading strategy. Therefore, we added the Sideways Market Analyzer to the very end of our list.

Here are the links for all the software to form a complete Price Action and Pattern Trading System

- Harmonic Pattern Plus (More info at http://harmonicpattern.ucoz.co.uk/)

- Price breakout Pattern Scanner (More info at http://fxpricebreakout.ucoz.com/)

- Sideways Market Statistical Analyzer (More info at http://tradesideways.ucoz.com/)

- Price Action Candle Detector (More info at http://www.mql5.com/en/market/product/5452)

- Risk Management Tool (Free, More info at http://www.mql5.com/en/market/product/5452 )

- NRTR (Free, More info at http://www.mql5.com/en/code/8349)